Montserrat Peidro-Insa with global account manager at Heidelberg Thomas Heissler (left) and MPS Obersulm managing director Götz Schümann

As Heidelberg prepares to ramp up production of its Primefire 106 press to meet high demand, Neel Madsen spoke to Montserrat Peidro-Insa, senior vice president for digital printing, to hear more about how converters are using the technology.

‘You need market demand and a robust technology in order for digital print to be adopted successfully, and it is the brands that generate that demand,’ said Ms Peidro-Insa. She was speaking at PrintWeek Live about the Primefire 106 B1 sheetfed press, which ‘is here to accelerate growth for companies.’ We caught up with her after the presentation to drill down on just how the press fits into the market and into the folding carton manufacturers’ existing workflow.

Waiting list

Aimed squarely at high quality, industrial production of folding cartons, the Heidelberg Primefire 106 digital press first put ink on substrate in December 2015. It was formally introduced to the world at drupa 2016 and installed at the first beta customer, MPS-Westrock in Germany, in June 2017. Colordruck Baiersbronn in Germany put the press in this past January and August Faller Group will be the first pharma customer, while the first installation in the US, at Warneke Paper Box in Denver, is scheduled for June. Demand for the machine is high – all units to come out of the factory throughout this year and halfway into 2019 have already been sold. These will be mainly going to the US, China and mainland Europe, with Heidelberg ramping up production to meet demand.

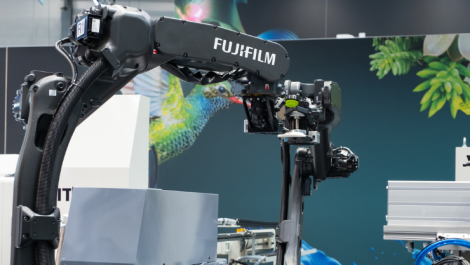

The press uses paper-handling technology from the company’s XL 106 offset press, including feeder, coating and drying. It features direct printing technology developed in partnership with Fujifilm, which supplies the Samba printheads, and this partnership has been vital to ensure good integration, said Ms Peidro-Insa. The inkjet printheads produce a 1200 x 1200dpi resolution, with a minimum droplet size of 2 picolitres using dedicated Saphira water-based inks in seven colours, which conform to the Swiss Ordinance for food contact.

It is a highly productive press capable of printing some 1.5 million B1 sheets per month, which translates to an awful lot of jobs, but Ms Peirdro-Insa was quick to point out that it is not all about how fast you can print the jobs. She said, ‘Of course, we need good speed, but it is just a number we write down for comparison; it is the combination of speed and uptime that is important. You need to find a steady speed throughout your workflow. Printing faster will just create a bottleneck in finishing.’

Fill to capacity

So what type of applications are Heidelberg’s customers planning to produce? General folding cartons applications, found in every shop and supermarket, make up about 75%. For those converters, the press makes short runs profitable, offers fast turnaround and a quick response to new market demands, as well as the opportunity to produce new and unique products for brands. Pharma applications account for 18%, with traceability and regulatory demands driving the need for digital printing so that each box is unique. Posters, playing cards and calendars make up around 5% and short run book covers the last 2%.

But with a high price tag comes the need to fill the press to capacity. Ms Peidro-Insa is pretty straightforward in her response when asked about return on investment. She said, ‘You have to be able to fill the press with at least 1.5 shifts’ worth of jobs. If you can fill two full shifts then it will be profitable, and it is important to understand where these jobs are coming from. You have to look at what you are already producing in house, but also at creating new revenue streams.’

Speaking about how Heidelberg and its customers work out the economic model and the ROI for the folding carton press, she explained, ‘It has to be a win-win situation; the manufacturer makes money and the customer makes money, otherwise no one makes a profit. In many ways, it is like a marriage. We have to understand each other.’

The press manufacturer will base its economic analysis on what the customer wants to produce on the press to ascertain profitability. ‘Most often, our customers start out wanting to use the press just for short run jobs, but they quickly realise that they will miss out on the exponential growth they can achieve with the additional value of the machine. They start looking at other products that is not already produced in house and at investing in more technology to add value and create new streams of revenue.’

Finishing future

While the current demand means that output is mainly short run jobs, where the print may be different but the shape of the box is the same, there is no immediate need for printing companies to invest in new finishing solutions; they simple gang the jobs together and slot them into the existing workflow. But branching out into new markets and offering new types of applications will put new demands on finishing in the longer term.

Ms Peidro-Insa said, ‘When printers first think about the Primefire, they like it because it fits with the finishing solutions they’ve got. They already have the dies and all the tooling needed so they don’t have to invest in more. So if all they’re doing are short runs, they can simply convert them on the existing finishing equipment.’ She continued, ‘But what happens when you want the Primefire to do every single box shape differently or you have 100 different shapes to convert?’

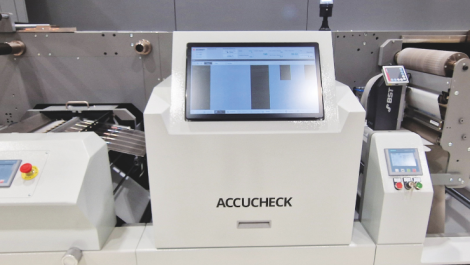

Her prediction is that in two years’ time, there will be a proliferation of digital finishing devices coming onto the market, especially die-cutters, to deal with this issue. She said, ‘In fact I hope the first one will come from us, as we are working on a project for a digital finisher with die-cutting and inspection that is fully integrated with the Primefire workflow.’ In terms of adding more finishing capabilities, the company is also developing a digital embellishment machine to complete the solution.

When asked about potential customers in the UK, Ms Peidro-Insa said that Heidelberg is working with some of the big packaging companies, but that none have reserved a unit so far. Her prediction is that the first UK customer will be a group of mid-sized companies coming together to invest to take advantage of the capabilities. She concluded, ‘The market demand for digital folding cartons is there and we have a proven solution. The Primefire is not just another ’boutique’ digital press. We offer a solid, dependable technology that will support business growth.’