EFI Jetrion label samples

Another year, another round of inkjet developments as further progress was made in 2014 with the promise of more in 2015. Technical editor Sean Smyth offers a view of the market and what we can expect to see this coming year.

Growth in narrow web and new high performance systems is coming on apace (wide format inkjet is covered on pp 21-23). Besides wide format, there are effectively four quite separate technology strands: 1. Narrow web – labels, including much hybrid development, some flexible; 2. Wide web – corrugated and some flexible; 3. Sheetfed – cartons, corrugated (and corrugated laminate); and 4. Bespoke systems in packaging/filling supply chains, cans and bottles.

Narrow web

The narrow web inkjet sector is extremely crowded. At Labelexpo last September, there were over 30 suppliers selling high performance label presses, with a few more offering hybrid inkjet systems that can be mounted onto existing flexo lines for single and multi-colour imprinting. It was very interesting to see both Mark Andy and Gallus offering their new inkjet systems; there are very few major analogue press suppliers who are not looking toward inkjet solutions as part of their portfolio.

Epson reported more than 100 installations of its SurePress L-4033AW system worldwide with Superfast Labels, in Kent in the UK, putting a second machine in during 2014. This machine is relatively slow, but quality is very good. It uses water-based inks printed with a multi-pass mechanism to lay down six colours, so white may be base, middle or top printed. Epson showed a faster, single-pass UV narrow web press, but this is still under development.

Water-based inks are in the minority today in labels, although Miyakoshi and Colordyne are selling such presses. In January, Colordyne Technologies improved the performance of its 3600 Series with a new Aspen memjet engine upgrade. The upgrade allows the 3600 Sprint to run up to 84 m/min at a resolution of 1600 x 1375 dpi. Actual speed depends on the job drying, substrate and operating adjustments.

The inkjet narrow web market leader in terms of installations is EFI, with the Jetrion presses. The Jetrion 4900 series features optional integrated laser finishing to allow single pass printing and finishing

with no mechanical dies. This is also a feature of the INX Digital inkjet press. Domino is currently performing very strongly with its N610i label press, highlighting the success in the annual result statement from chairman Peter Byrom, who said, ‘Our latest full colour digital label press has been well received by customers and we are seeing increasing adoption of digital printing technology among label converters. Activity levels among our sales teams, and the increase in sales of the N-Series digital label presses this year, give us confidence in the potential for continued growth.’

One user is label converter QRT Graphique, based in the south of France at Alès, which produces for the agri-food, chemical and cosmetics industries using flexo, offset and screen presses. It installed a four colour plus white N610i to print on transparent, synthetic gold and silver substrates. Runs up to 400,000 labels have been produced, with the company seeing dramatic reductions in lead times as a significant advantage. This investment has allowed QRT access new markets. The UV ink produces an effect similar to screen printing with good abrasion resistance, and the company has won new customers from sectors where these qualities are extremely important, eg distribution companies needing undamaged labels on delivery.

Screen is also moving forward with four Truepress Jet L350UV machines now in operation across Europe. There are two being installed and there are three more orders in hand as well as Asian and North American sales. Two of the installations have been done with partner Dantex, including Limpet Labels in Wrexham, the second UK install after Springfield Solutions in Hull took the first machine. Limpet bought the press to widen its production portfolio, believing that operating a range of print technologies is the key to offering customers the best possible quality and service for their requirements.

The Truepress Jet L350UV prints widths up to 322 mm at 50 m/min, with a higher economic cross-over against flexo. As Limpet also has Xeikon and flexo presses, it can advise customers on the best way to achieve the labels they want. In most cases digital produces a cleaner image than its analogue printed equivalent, and some customers are willing to pay a little more for it on longer run jobs.

In Germany, the first Screen label press was commissioned at Labelprint24 in Grossenhain, which is pioneering online label production. According to managing director, Stefan Harder, ‘The new press delivers everything today’s label buyers expect from a leading manufacturer -personalisation, fast turnaround, first class quality and, combined with our intelligent systems, affordability.’

Labelprint24 is one of the most innovative label printers in Germany, producing sheet and roll labels for cosmetics, healthcare, food and manufacturing. Labels range from simple to highly complex products incorporating multi-layer informational booklets, all of which can be ordered online. It is part of the Harder Group which pursued an all-digital strategy, launching Labelprint24 in 2010 as a web-to-print B2B portal for customers to order labels. It sells into Germany, Austria, Switzerland, Poland and the Czech Republic, and there are plans to expand into France, Italy, the Netherlands and Belgium.

Mark Andy Digital Series hybrid inkjet/flexo press

In high-definition print mode, the Durst Tau 330 can deliver a resolution of 720 x 1260 dpi. It now also comes with an inline finishing option, the LFS 330, for converting in one pass. This incorporates laser die-cutting technology from Spartanics with a 1000 Watt laser. It is available is two printing widths, and up to seven colours, CMYK plus white, orange and violet.

TLF Graphics, in Rochester, NY, invested in the new Durst Tau LFS 330 UV inkjet press after seeing it at Labelexpo Chicago last year. Bob McJury, vice president for sales and service, explained that the company had been planning to upgrade some of its existing toner-based equipment – but postponed that plan after attending the show and seeing the Tau LFS 330. He said, ‘It’s a game changer for us. It absolutely fits the market we serve perfectly.’ Over time, the company intends to transition 40% of its screen printing work to the Tau. ‘The Tau LFS 330’s implementation at TLF Graphics is really beginning to take hold,’ he concluded.

Most narrow web inkjet is for labels, but not all. Durst has a couple of customers producing lidding film using low migration UV inks from SunJet. Other flexible packaging applications include blister packaging. IIJ has a system printing onto filled pharmaceutical blisters, while Swiss manufacturer Hapa has a very successful niche in late-stage customisation and printing in pharmaceutical applications.

Hybrids

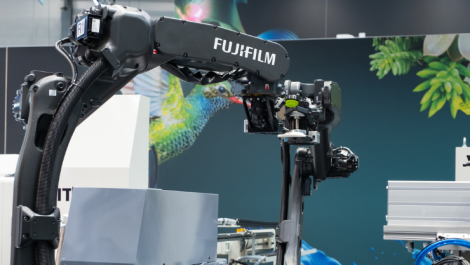

Another trend is the rise of hybrid flexo and inkjet systems. This can be new presses, as those from Mark Andy and the FFEI/Fujifilm Graphium, or add-on units from suppliers such as Industrial Inkjet Ltd or PPSI and others. There are several turnkey hybrid systems available to buy now and adding a digital unit to an existing machine can be a low cost, low risk way of adopting digital, providing the benefits to customers. Repurposing an existing press will usually be cheaper than buying a new line, and standing plates and dies can be used avoiding a potentially expensive write-off.

Prototype & Production Systems, Inc. introduced its first Digital Inkjet Color Engine (DICE) UV inkjet add-on for narrow web flexo presses in 2010. PPSI is not alone. Amica Systems in California has a suite of single pass inkjet digital printing systems with the colour Morpho and mono Venus systems. It claims to have over 100 systems in use in various applications.

IPT (Innovative Printing Technologies) Digital in Florida has multiple installations of its JFlex870 digital conversion system on Aquaflex, Comco and Nilpeter machines. In 2014, it reported the first Mark Andy installation onto a 2200 series press.

Andy Cook, FFEI’s managing director, is optimistic about the prospects for the Graphium, highlighting the potential for hybrid production. He commented, ‘Last year we saw real adoption of inkjet technology by label convertors with a significant growth of inkjet presses in production. People no longer question the readiness of inkjet, it’s more about when and how they deploy it.

Looking to 2015, I think we will see an increasing number of digital hybrid label presses being installed, as label converters focus on the end to end efficiency of production. The ability of a press to handle a wider range of applications competently will also become critical, for example printing top and base white in a single pass opens up many new possibilities. We’ve been taken aback by the interest that Graphium generated at Labelexpo. Converters will want more of this capability in order to deliver ever more creative and ‘added value’ applications.’

To be successful the hybrid flexo and inkjet combination has to provide a solution greater than the sum of the parts. Users are now exploiting the benefits of both processes, the installations are growing. There may be environmental and sustainability benefits, eliminating plate making and reducing waste through the supply chain. Both processes have advantages and drawbacks, but if done correctly the combination can be more effective.

Sheetfed

The sheetfed inkjet sector has proved to be slow in taking off. Screen is using its B2 simplex Truepress Jet SX for a range of applications including cartons and corrugated. Fujifilm has launched the second generation of its Jet Press 720S primarily for commercial applications but short run packaging is also a target market. It uses water-based inks, applying a primer to coagulate the ink on the surface of the paper.

Konica Minolta will be launching its KM-1 UV curing inkjet press that features a slick paper transport system from Komori, which will be selling the press as the Impremia IS29. The four colour heads are arranged above a cylinder that holds the paper or board in position during printing, and there is no duplexing facility. There is a calendaring device after the curing that helps minimise the relief effect of UV inkjet and boost quality.

The corrugated sector is being targeted by inkjet suppliers. Wide format and flatbed systems are being used, with specialist machines designed specifically for corrugated coming to market. HP is using its high speed inkjet and is now working with KBA to develop new roll-to-roll inkjet solutions for the high volume corrugated packaging market. The first installation of the HP High-speed Inkjet Corrugated Packaging Solution is printing liner at Obaly Morava in the Czech Republic. There is a near-line coater for aqueous priming and over-coating printed substrates.

The company plans to eventually move this coater inline for priming and add a second coater for inline top coating. Future co-developed solutions will be marketed under the HP brand and will be aimed at helping converters increase productivity, scalability and versatility. The agreement with KBA demonstrates HP’s continued pursuit of corrugated packaging opportunities and intention to broaden its portfolio of inkjet products and solutions.

Bobst is finalising its sheetfed inkjet machine for corrugated and cartons, working in conjunction with Kodak. Sun Automation has launched the CorrStream inkjet sheetfed corrugated machines with the first installations now in operation. Also in corrugated, Engico, Barberan and Xanté have all shown inkjet systems.

And more innovation

The flexibility of inkjet means there is a very wide variety of packaging print systems using the technology. Machines Dubuit and INX Digital sell a range of tube and flat metal printers, while there is a lot of interest in direct to pack printing with the Konica Minolta powered Martinenghi Michelangelo high performance can and aerosol printer. In Germany Till Engineering is selling the Smartprint module, inkjet printing bottles with several major brands looking at the technology.

The equipment and ink suppliers see labels and packaging as a huge and potentially lucrative market opportunity and they are investing huge amounts of money in new systems. There is a great deal of innovation, with the quality, reliability and productivity of equipment steadily improving.

The ink technology is also developing. UV curing inks are widely used but there are real concerns about odour and migration that are restricting adoption in food applications. Marc Graindourze, business development manager for industrial inkjet inks at Agfa, commented, ‘Agfa has strongly invested to develop a low migration UV-curable inkjet ink technology. This unique ink technology is based on high performance ink compounds delivering a very low amount of ink compounds which can migrate through the substrate and/or being transferred to the food contact side by set-off and developed for printing direct on food containers, labels, blister foils, secondary packaging, but is also targeted to printing on packaging of pharmaceuticals.’

As ink technology develops, many of these concerns will be solved with new materials, or using alternative ink types. Despite the recent entry of big boys Mark Andy and Gallus, there will be a fallout of suppliers in the narrow web sector as the market matures, while theleaders will transfer their inkjet expertise into other packaging applications. Inkjet adoption is growing rapidly in corrugated, cartons, glass, metal, and flexibles, with corrugated the next sector that will adopt the benefits of inkjet production.