The global market for folding cartons will hit $172 billion by 2026, with wider use of digital printing expected.

According to Smithers ‘The Future of Folding Cartons to 2026’ the folding carton will be worth $136.7 billion in 2021. As the market recovers from disruption caused by Covid-19, global demand will reach $172 billion in 2026.

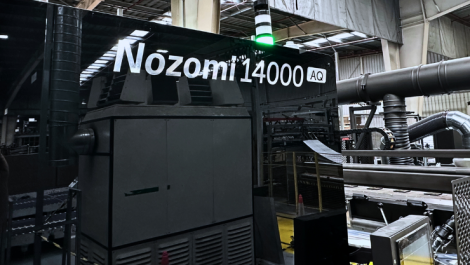

In terms of digital’s role, inkjet and electrophotography systems will take on a larger share of work, with higher speed presses to provide quick turnaround and variable data print to complement existing higher throughput analogue presses.

Looking at the current market, the coronavirus pandemic slowed, but did not reverse rising demand for more cartonboard packaging witnessed across the 2010s, according to Smithers. Converted carton volumes rose marginally from 48 million tonnes in 2019 to 48.30 million tonnes in 2020. Volumes are forecast to rise further to 61.58 million tonnes in 2026.

Production volumes rose by just 1.6% in 2019-2020 and conversion volumes increased by less than 1% during the year. Total cartonboard production – materials sold to converters – will be a projected $46.28 billion in 2021, based on Smithers’ latest price estimations.

As the threat of the pandemic recedes, folding carton packs will increase by 2% for 2020-2021, before recovering to a 4.6% compound annual growth rate (CAGR) through to 2026. The demand for new volumes will be led by Asia, while the North American and mature European markets will see some loss of market share.

The pandemic has affected end user consumption of folding carton packaging in varying degrees with different sectors exhibiting a range of recovery rates. Soft drinks volumes have seen the greatest decline in the past year, while for dry foods folding cartons enjoyed good growth in 2020. Medium term consumption is expected to show the highest growth rates in the confectionery and dry foods sectors.

Sustainability will encourage wider use in some segments, as consumer, retailer and brand owner concerns over the environment lead to substitution of plastic materials. This is also seeing more interest in recycled grades, with the nascent market for uncoated recycled board seeing the fastest growth over the Smithers forecast period. This will be supported by legislation in many jurisdictions, and places an emphasis on the evolution of sustainable barrier technologies, especially for food-contact applications, like fresh produce trays.

E-commerce has become a focus for many retailers in 2020, with online sales rising by 25% over the year, even as overall retail sales fell by 3%. This is particularly focusing attention on microflute formats that can be litho laminated to exteriors of corrugated e-commerce delivery packs.

In the short term there has also been the design challenge for folding carton converters to develop new pack formats for pharmaceuticals and other Covid-19 supplies, such as home test kits. With more online sales and trade in more sensitive goods there will be an increased use of tamper-evidence and other security packaging features though to 2026.

Geographic shifts are being reflected in converting capacities, even as the paper segment looks to adjust to a post-Covid world. In 2018-2020, Smithers estimates nearly three million tonnes of new cartonboard manufacturing capacity came on stream, although this was offset by the closure of over 2.2 million tonnes. The new machines installed over this period included over 2.4 million tonnes of additional capacity in China.