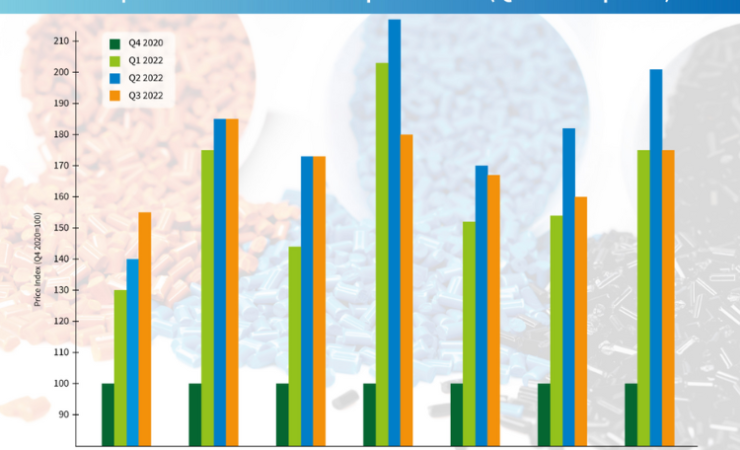

Following two quarters of surging prices in the first half of 2022, flexible packaging raw material prices have stabilised, despite energy prices significantly rising across the region.

According to Flexible Packaging Europe (FPE) growing economic uncertainty has affected demand from both converters and end users as consumers are being more cautious due to high inflationary pressures across a range of packaged goods.

The price for 60gsm one-sided coated paper climbed (up 11%), while 7-micron aluminium foil and 15-micron BOPA held steady at their price. 20-micron BOPP film, which dropped 17% compared to the previous quarter is still up by 10% vs. Q3 2021. Both LDPE and HDPE price increases are currently stabilising compared to last year and experience double-digit declines of 13% and 12% vs. Q2 2022 respectively. PET film price was down by 2%, a modest fall in 2022.

This stabilisation is only a temporary relief for both converters and brand owners who have experienced seven successive quarters of surging prices for most flexible packaging materials, stretching back to the final quarter of 2020.

David Buckby of Wood Mackenzie, which collects the data, said, ‘For the most part, European substrate prices peaked in Q2 then broadly stabilized in Q3. Paper pricing grew on average by around 10% in both Q2 and Q3, while BOPP pricing slumped by almost 20% in Q3. Price hikes in Q2 were largely driven by escalating raw material and energy costs, exacerbated by Russia’s invasion of Ukraine.

‘Towards the end of Q2 and into Q3, substrate demand growth slowed primarily due to economic uncertainty. Several converters and major brands reported negative volume growth in Q2, although stronger results were noted by some depending on segment exposure. Flat or declining raw materials pricing also supported the broadly stable substrate pricing environment in Q3, although any declines were far outweighed by rising energy prices. The main risks to the outlook in Q4 appear to be worsening economic conditions and energy pricing and supply.’